September 18, 2018

Outsourcing has become a more common method for many businesses to store products and transport materials from suppliers and manufacturers to their end destination, and third-party logistics (3PL) companies have helped streamline the process. But what happens when your products become damaged, lost, or stolen?

Over the course of this blog post, we will discuss the most common types of insurance policies and what you need to know before you decide to sign up with a 3PL warehousing provider.

Since your goods are your business, transporting them safely from your production facilities to their subsequent warehouses and their safe delivery to your customers is one of the most important considerations that you have to make as a business owner.

Goods in warehouses are exposed to possible fire, flood and other damage. While protecting your goods may be one of the reasons you store products in a warehouse, using 3PL partners potentially opens the door to theft and mistakes in tracking inventory if they do not have the right warehouse management system (WMS) or inventory management system (IMS) in place.

If your goods are lost or damaged while in the hands of a 3PL warehouse provider, you could be looking at losses in revenue of tens of thousands of dollars or more without the ability to recoup those losses. As a business owner, whether using 1,000 sq. ft. or an entire dedicated 3PL warehousing facility, it would be wise to ensure your goods are protected from additional liabilities.

Under the United States Uniform Commercial Code (UCC), a warehouse owner assumes responsibility for the goods they store for others for a fee. If a facility experiences an incident and a customer’s goods are damaged, the warehouse owner can be held liable for failure to exercise reasonable care over their possessions. Warehousing claims may arise from theft, fire, flood, lack of refrigeration, roof collapse, missing inventory, damage during handling, insufficient facility maintenance, trailer theft and a number of other causes.

That’s why asking the right questions and choosing the right 3PL warehouse provider is such a critical decision. Many potential warehouse customers often ask us questions about what kinds of insurance is required when using a 3PL warehouse provider and what kind of insurance is included in their contracts.

This blog post is all about answering those important questions and giving you a deeper understanding of the warehouse industry so that you can make informed decisions.

Each of the several possible types of insurance that a 3PL provider can possess has a different level of coverage and will cover your goods for different scenarios.

Below are the three most common types of insurance that you need to be aware of when entering an agreement with a 3PL provider for warehousing and transportation services and what it means for your business.

What is warehouse legal liability insurance?

In short, it means that the provider of the warehouseman must exercise responsible and safe storage of your goods while in their care, to the same level that a reasonably careful man would provide. If this level of care is not provided, and their negligence results in damaged goods, then the warehouseman's Warehouse Legal Liability policy will cover the goods up to the agreed maximum coverage as detailed in the warehouse contract. This Coverage will only pay damages to your goods if the warehouseman’s negligence is the cause of the loss or damage.

Any other type of damage or loss of the goods is the sole responsibility of the customer. These types of damages include, but are not limited to, fires, natural disasters, floods, etc.

When 3PL warehouse providers a level of care greater than the legal definition of “reasonable care”, then the insurance provider will most likely NOT cover damages in the event of lost or damaged goods.

In the event your 3PL warehouse provider chooses to offer a higher level of care than what the insurance policy claims as "adequate", then you will need to ensure that the contract you sign discloses who will cover the damages to goods in the event the insurance company does not cover the costs.

What is business interruptions insurance?

In the event of a natural disaster or other business interruption, business interruptions insurance covers the warehouse and pays the 3PL warehousing provider their lost revenue during the time that they were unable to conduct business.

This kind of insurance will only cover the warehouse provider, not the customers that are storing their goods there.

There is also contingent business interruption insurance which means that in the event one of your warehouses cannot operate and you lose profits during the time that they were inoperable, you would be able to file a claim with your insurance provider to cover the losses during that time if you purchase this coverage.

This would be something that you would need to purchase outside of any warehouse provider you decide to do business with, but could be incredibly beneficial to you as you expand your business and increasingly rely on third party logistics providers throughout the country.

What is transportation insurance?

Transportation insurance, just like other insurances and warehouse legal liability insurance, has varied clauses, legal definitions and limitations to when and how much you’ll get reimbursed if your goods are lost or damaged while they are being transported.

In the event your goods are damaged and the carrier was negligent during the transport of the goods to their destination, basic transportation insurance states that the insurance provider will pay your for loss or damage up to a contractual limit.

When the circumstances are outside of the control of the 3PL carrier, your business is still responsible for loss or damage due to these natural disasters or other causes. When you’re reviewing the contract for responsibility during transport, make sure you understand and agree to the definition of negligence that the carrier is using.

One final piece to take into consideration when choosing transportation insurance: payment for the loss of goods. Depending on the circumstances, payments can be made based on loss of profits, wholesale price of your goods or price per pound of your products.

Communicate with Your 3PL

There is no substitute for you talking to your 3PL provider about who will be responsible for losses and damages. These types of claims and their resolution need to be documented in the contract. Often, warehouse claims are a result of aggravated customers who expect one thing in case of a loss, but received another. The missing element was communication.

Educate customers about the options and discuss the costs. In the end, you should have a written contract that clearly describes your responsibilities. This will minimize future disagreement and misunderstandings. More sophisticated insurance brokers can tailor insurance to these contracts.

Summing Up

The three insurance types detailed above are examples of the most common kinds of insurance required when using a 3PL warehouse. Based on your specific business needs or products being stored & transported, these may be insufficient for your needs. It’s always best to consult a professional or a lawyer when drafting or signing contracts that could impact your business’ bottom line.

Insuring your warehouse operations may not be a logistical nightmare, but it is far less cut-and-dry than insuring a delivery van, for example.

Practicing good loss control techniques and communicating with your customers' can reduce your risks and make insurance more affordable.

Warehouse insurance comes in different varieties, and even policies with the same title may provide very different levels of protection. If you are unsure of what insurance policy you need, it can really pay off to consult a specialist.

In the long run, a well-insured warehouse will also be the most profitable.

If you have any questions about insurance or any other aspect of 3PL warehousing or transportation, feel free to contact us.

Tags:

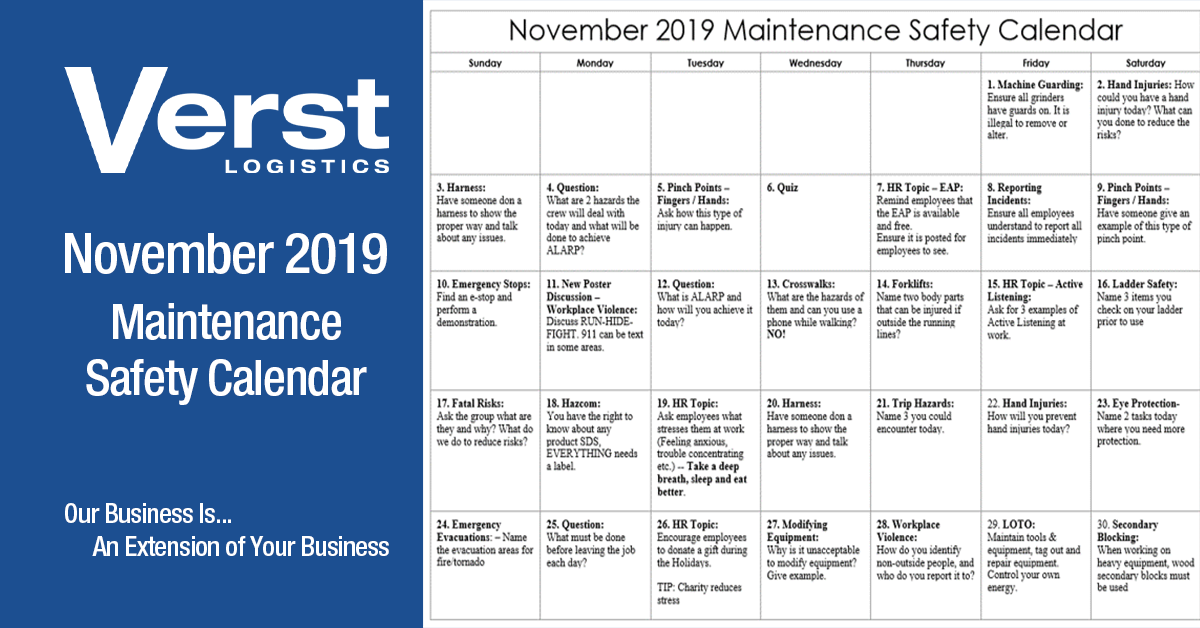

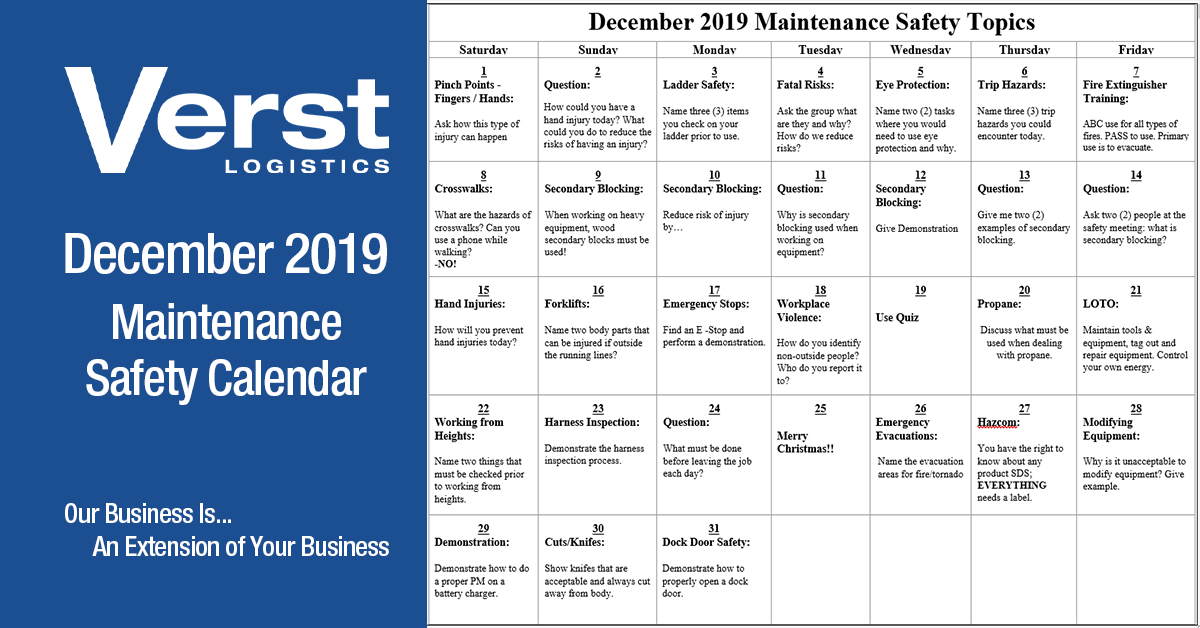

Regular maintenance is required to keep all equipment, machines and the work environment safe and reliable at all times in the warehouse. Dangerous situations, accidents and health problems can occur...

Regular maintenance is required to keep all equipment, machines and the work environment safe and reliable at all times in the warehouse. Dangerous situations, accidents and health problems can occur...

Resources

Connect